MCAI Legacy Vision: Simulating Nordstrom’s Latina Cultural Path

Forecasting Latina Integration, Brand Resonance, Institutional Adaptation

I. Executive Summary

Nordstrom remains one of America’s most trusted legacy retailers. Known for its elegant restraint, exceptional service, and multigenerational leadership, the brand has long been a symbol of aspirational, understated luxury. Yet in a marketplace reshaped by cultural acceleration and digital-native consumers, heritage alone no longer guarantees relevance. Today, Nordstrom stands at a decision point: preserve its identity as-is, or expand its legacy by integrating new cultural expressions.

MindCast AI LLC (MCAI) captures, models, simulates judgement and forecasts the decisions of people and institutions. We capture emotional resonance and judgment heuristics using patent-pending Cognitive Digital Twins (CDTs). Our CDTs do not predict outcomes—they simulate and forecast how a CDT identity behaves under strain, narrative shifts, and market transformation. MCAI has supported legal strategy, investment forecasting, and institutional reform across public and private sectors.

We selected Nordstrom for simulation because it embodies both strength and drift—an elegant brand losing tonal relevance among multicultural, younger consumers. This study models what happens when Nordstrom chooses to integrate Latina culture as a living expression of its values. We simulate how elegance evolves, how resonance scales, and how legacy survives by becoming more emotionally inclusive.

II. What is Nordstrom’s Legacy?

To shape the future, Nordstrom must first understand its institutional DNA. This section unpacks the brand’s core traits—radical customer service, multigenerational leadership, understated luxury, and emotional ritual. These strengths once created generational trust and aspirational elegance.

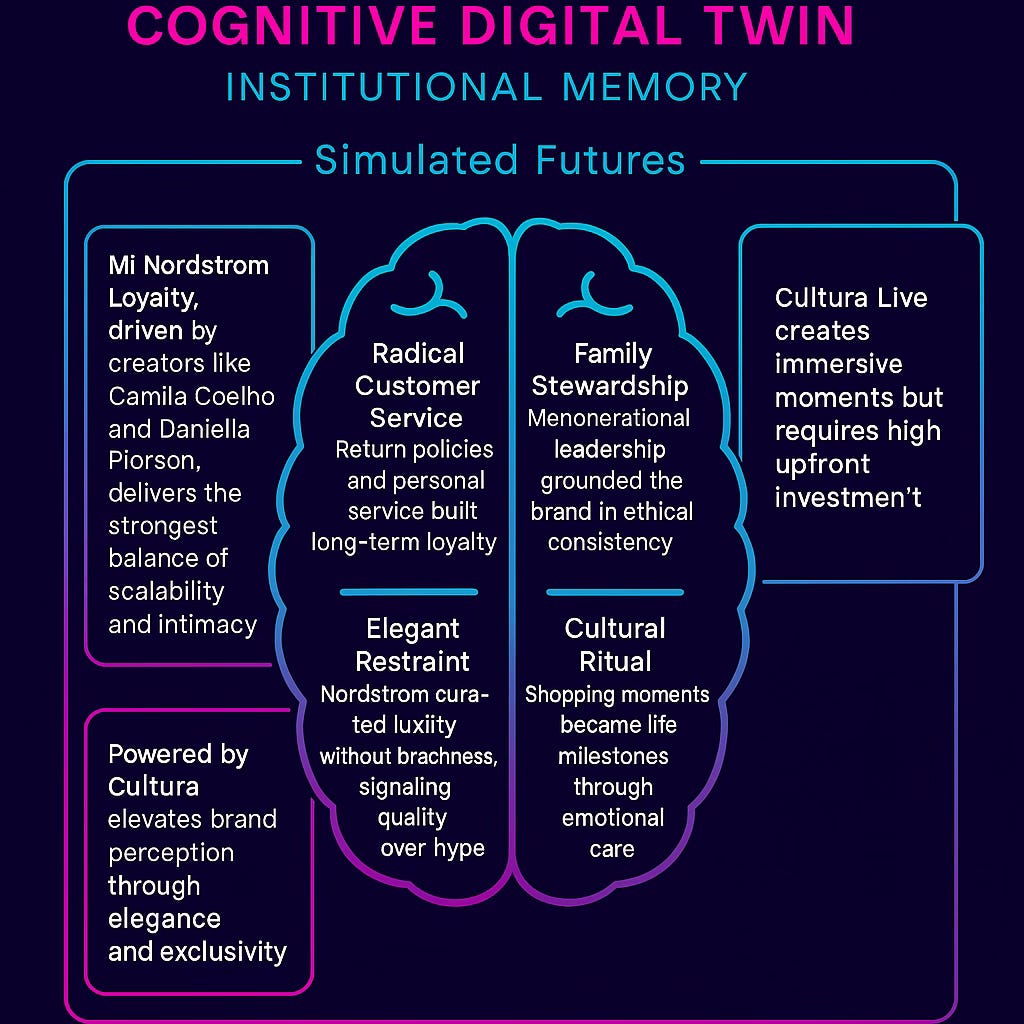

Analytical Vision CDT Profile: This flow highlights Nordstrom’s harmony between emotional tone and institutional rhythm. Nordstrom expresses compositional coherence through trust, refinement, and grace, but currently operates in a tonal register that underrepresents multicultural voices. The brand delivers an elegant composition but risks sounding one-note unless it introduces richer emotional motifs. To evolve, Nordstrom must expand its score to include Latina cultural cues, bilingual phrasing, and rituals that resonate across generations.

🧠 Analytical Vision CDT Scorecard:

🎻 Compositional Integrity: 82/100 – Nordstrom maintains internal harmony, but rigidity emerges as cultural complexity increases.

🌐 Tonal Modernity Index: 61/100 – Outdated language and style dilute relevance to younger, more diverse audiences.

🔄 Cultural Modulation Readiness: 74/100 – Structural readiness exists, but success hinges on bold execution.

✴️ Clarity Compression Index: 77/100 – Strategic themes remain coherent under pressure, but lack fresh compression cues.

🧩 Signal Subtlety Index: 73/100 – Nuanced brand traits signal refinement, though narrative clarity fades in younger demos.

💡 Fluid Regulation Integrity: 79/100 – Decision systems respond fluidly to known scenarios; less agile with cultural novelty.

📊 Analytical Vision Depth Score: 72/100 – Nordstrom shows moderate strength in translating structured service logic into culturally responsive systems. Its analytical capabilities are well-formed but must evolve with modern input signals.

Emotional Vision CDT Profile: Chopin Vision reveals Nordstrom’s deep emotional intelligence and rising narrative tension. The brand continues to stir sentiment and elegance, yet fragility emerges. Customer experiences like return policies, styling services, and personal shopping used to create soft, resonant moments. Now, they feel thinner. To restore emotional weight, Nordstrom must draw from Latina traditions—family, celebration, and expressive aesthetics. A Chopin-aligned Nordstrom deepens feeling through nuance, not scale.

🎹 Emotional Vision CDT Scorecard:

🎼 Emotional Vision Depth Score: 81/100 – The brand retains a strong ability to build emotional resonance and sustain ritual depth. Latina cultural fluency could elevate this to best-in-class storytelling.

✴️ Clarity Compression Index: 80/100 – Emotional themes remain coherent under evolving formats, but lack cross-platform rhythm.

Nordstrom’s legacy embodies:

💼 Radical Customer Service: Return policies and personal service built long-term loyalty. These rituals signaled trustworthiness and compassion at every touchpoint. Today, they form the emotional anchor of Nordstrom’s brand memory.

👨👩👧 Family Stewardship: Multigenerational leadership grounded the brand in ethical consistency. This continuity projected stability to consumers and employees alike. It also reinforced a values-based approach to brand management.

🕊️ Elegant Restraint: Nordstrom curated luxury without brashness, signaling quality over hype. The brand built aesthetic authority through understatement, not spectacle. This trait now requires translation into digital and multicultural fluency.

🎁 Cultural Ritual: Shopping moments became life milestones through emotional care. Nordstrom’s role in holidays, celebrations, and personal transitions cemented its place in family memory. These rituals can evolve to include Latina tradition and generational storytelling.

Nordstrom never chased trends—it defined grace through subtlety. Today, as Bad Bunny redefines couture and Rosalíachannels generational fire, elegance must move in rhythm with culture.

III. Scenario Simulation: Latina Culture Integration

MCAI’s CDT simulation modeled these diverging outcomes by forecasting how Nordstrom’s institutional identity, tone, and foresight logic would perform when challenged with cultural expansion. The simulation captures not only external behavioral outcomes like engagement or purchase intent, but also internal coherence—how Nordstrom's emotional memory and brand voice hold under new narratives.

The following scenarios represent simulated futures based on Nordstrom’s CDT model. We tested each path for alignment with emerging cultural values, narrative risk, and emotional resonance.

We modeled two contrasting scenarios to assess the strategic impact of cultural alignment.

Scenario A: No Integration

In this path, Nordstrom continues its current trajectory without embracing Latina cultural integration. This path echoes missteps made by legacy brands like J.Crew, which failed to modernize its aesthetic and narrative for multicultural relevance. J.Crew’s reluctance to evolve alienated younger and diverse shoppers—Nordstrom risks a similar fate if it clings too tightly to tradition.

Scenario B: Strategic Integration

Here, Nordstrom fully embraces Latina design fluency, bilingual messaging, and cultural storytelling.

Key Enablers:

👗 Co-branded Collections: Collaborate with Latina-founded labels like Johanna Ortiz, Farm Rio, and Cuyana. These partnerships infuse elegance with cultural specificity and give Nordstrom permission to enter new cultural conversations. They also generate press-worthy moments that resonate across both luxury and community platforms.

📅 Cultural Calendar Capsules: Launch campaigns tied to Latina celebrations—Día de los Muertos, Quinceañera season, Hispanic Heritage Month. These activations link tradition with retail theater and allow emotional storytelling through limited collections. They foster intergenerational resonance and drive seasonal loyalty.

🏬 Storytelling Retail Environments: Transform Nordstrom locations into storytelling hubs for Latina creators and their communities. Use installations, pop-ups, and curated sections to immerse shoppers in cultural experience. These hubs turn physical retail into emotional memory zones.

IV. Strategic Recommendations

To remain culturally fluent while preserving its legacy, Nordstrom must act with precision and narrative clarity. This section outlines actionable strategies that align institutional heritage with Latina cultural integration—bridging emotional equity, brand fluency, and execution.

Clarify the Brand Narrative 🖋️ Featuring brands like Carolina Herrera and guided by narrative clarity seen in Sephora's bilingual storytelling. Define whether Nordstrom is evolving or recasting its legacy. Don’t hedge. Align messaging, campaigns, and in-store experience to a unified identity. Let elegance include warmth, rhythm, and cultural fluency. Ensure internal stakeholders embrace and execute a singular vision. Banana Republic’s collapse into brand confusion illustrates the risk—unclear repositioning led to consumer detachment and declining loyalty.

Build a Latina Cultural Blueprint 🎨 Modeled after successes like Farm Rio and Selena Gomez’s Rare Beauty brand. Invite Latina creatives, designers, and cultural strategists to shape collections, marketing, and store design. Make collaboration long-term, not seasonal. Use iconic figures—Selena, Frida Kahlo, Camila Coelho—as brand inspiration, not decoration. Let these voices guide the aesthetic, narrative, and retail cadence of the brand.

Activate Partnerships with Purpose 🤝 Inspired by Camila Coelho Collection and Cuyana’s mission-led commerce. Co-create capsule lines with Latina-founded brands like Cuyana and Johanna Ortiz. Feature Latina celebrities and creators in brand storytelling. Make each partnership a cultural bridge, not just a product drop. Treat these collaborations as strategic pivots that evolve brand identity through resonance and co-ownership.

Recode Brand Language 🔤 Following linguistic elegance and dual-tone identity from brands like Dior Beauty en Español. Introduce poetic tone and bilingual phrasing into campaigns. Audit legacy copy for exclusionary language. Ensure every touchpoint—from signage to app UX—affirms cultural fluency. Speak in a voice that signals respect, relatability, and aspiration.

Run Regular Judgment Audits 📊 Mirroring reflective recalibration modeled by inclusive retailers like Ulta Beauty and Fenty. Simulate foresight blind spots using Cognitive Digital Twins. Use Latina-led focus panels to test resonance. Keep executive strategy tethered to evolving consumer identity. Use these audits to bridge institutional assumptions with real-time cultural feedback.

V. MCAI Forecast Assessment: Latina-Led Strategic Cost Modeling

Each scenario in this forecast reflects an output from MCAI’s simulation engine, which models not just consumer behavior but institutional alignment across emotional resonance, cognitive fluidity, and cultural agility. Rather than rely solely on past data or trend reports, this CDT model tests how Nordstrom would actually behave under different futures.

Strategic integration of Latina culture—through loyalty programs, capsule collections, and storytelling campaigns—offers Nordstrom a path to deepen emotional resonance while gaining financial agility. These forecast scenarios reflect not just transactional potential, but long-term brand equity uplift.

To quantify impact, we modeled three implementation strategies rooted in Latina cultural alignment. These forecasts combine narrative resonance, cost-efficiency, and forecasted ROI using MCAI’s CDT framework.

Forecast Insights:

💎 Mi Nordstrom Loyalty, driven by creators like Camila Coelho and Daniella Pierson, delivers the strongest balance of scalability and intimacy. It scales personalization across demographics while maintaining trust through narrative fluency. This approach aligns cultural elegance with operational efficiency.

✨ Powered by Cultura elevates brand perception through elegance and exclusivity. It positions Nordstrom alongside luxury players by integrating heritage aesthetics with curated cultural resonance. The capsule model boosts brand prestige while opening cultural participation.

🎤 Cultura Live creates immersive moments but requires high upfront investment. It turns retail into theater, connecting customers emotionally—but demands spatial, logistical, and experiential planning to succeed. When executed well, it converts store environments into cultural stages.

Barneys New York offers a cautionary tale. While it led in prestige, it never built cultural accessibility or digital resonance. In contrast, Cultura Live initiatives could anchor Nordstrom in emotional relevance while activating its experiential heritage.

Projected Uplift from CDT-Informed Latina Strategy:

📈 +10.3% revenue potential via cognitive fidelity optimization

💡 +8.5% uplift through zone alignment and narrative testing

🧩 +18.8% cumulative gain when deployed in tandem

By embedding cultural fluency into both design and decision systems, Nordstrom can lead through resonance—not reaction.

Clarify the Brand Narrative 🖋️ Featuring brands like Carolina Herrera and guided by narrative clarity seen in Sephora's bilingual storytelling. Define whether Nordstrom is evolving or recasting its legacy. Don’t hedge. Align messaging, campaigns, and in-store experience to a unified identity. Let elegance include warmth, rhythm, and cultural fluency. Ensure internal stakeholders embrace and execute a singular vision. Banana Republic’s collapse into brand confusion illustrates the risk—unclear repositioning led to consumer detachment and declining loyalty.

Build a Latina Cultural Blueprint 🎨 Modeled after successes like Farm Rio and Selena Gomez’s Rare Beauty brand. Invite Latina creatives, designers, and cultural strategists to shape collections, marketing, and store design. Make collaboration long-term, not seasonal. Use iconic figures—Selena, Frida Kahlo, Camila Coelho—as brand inspiration, not decoration. Let these voices guide the aesthetic, narrative, and retail cadence of the brand.

Activate Partnerships with Purpose 🤝 Inspired by Camila Coelho Collection and Cuyana’s mission-led commerce. Co-create capsule lines with Latina-founded brands like Cuyana and Johanna Ortiz. Feature Latina celebrities and creators in brand storytelling. Make each partnership a cultural bridge, not just a product drop. Treat these collaborations as strategic pivots that evolve brand identity through resonance and co-ownership.

Recode Brand Language 🔤 Following linguistic elegance and dual-tone identity from brands like Dior Beauty en Español. Introduce poetic tone and bilingual phrasing into campaigns. Audit legacy copy for exclusionary language. Ensure every touchpoint—from signage to app UX—affirms cultural fluency. Speak in a voice that signals respect, relatability, and aspiration.

Run Regular Judgment Audits 📊 Mirroring reflective recalibration modeled by inclusive retailers like Ulta Beauty and Fenty. Simulate foresight blind spots using Cognitive Digital Twins. Use Latina-led focus panels to test resonance. Keep executive strategy tethered to evolving consumer identity. Use these audits to bridge institutional assumptions with real-time cultural feedback.

VI. Conclusion: Legacy as a Living System

Nordstrom has a chance to lead not by reacting, but by anticipating. Cultural fluency, emotional intelligence, and strategic partnership must now drive what once relied solely on heritage. Anticipatory leadership enables Nordstrom to shape markets, not just follow them. When foresight becomes brand practice, legacy stops drifting and starts leading.

Latina cultural integration offers Nordstrom a path to deepen emotional resonance, reach emerging markets, and restore elegance as a living concept. The company doesn't need to abandon its values—it must evolve them to include rhythm, warmth, and modern identity. When brands align with emerging narratives, they gain permission to lead generational shifts. Cultural specificity becomes a catalyst for expansion, not a compromise.

To move legacy forward, Nordstrom must lead as both a curator of history and an architect of cultural relevance. This requires activating narrative memory while investing in emotional fluency. The future belongs to brands that connect identity to imagination.

Prepared by Noel Le, JD, Founder | Architect of MindCast AI LLC. Noel holds a background in law and economics, behavioral economics, and intellectual property. He spent his career developing advanced systems for intellectual property management. He developed the patent pending MindCast system to derive a predictive mechanism for behavioral economics. www.linkedin.com/in/noelleesq/

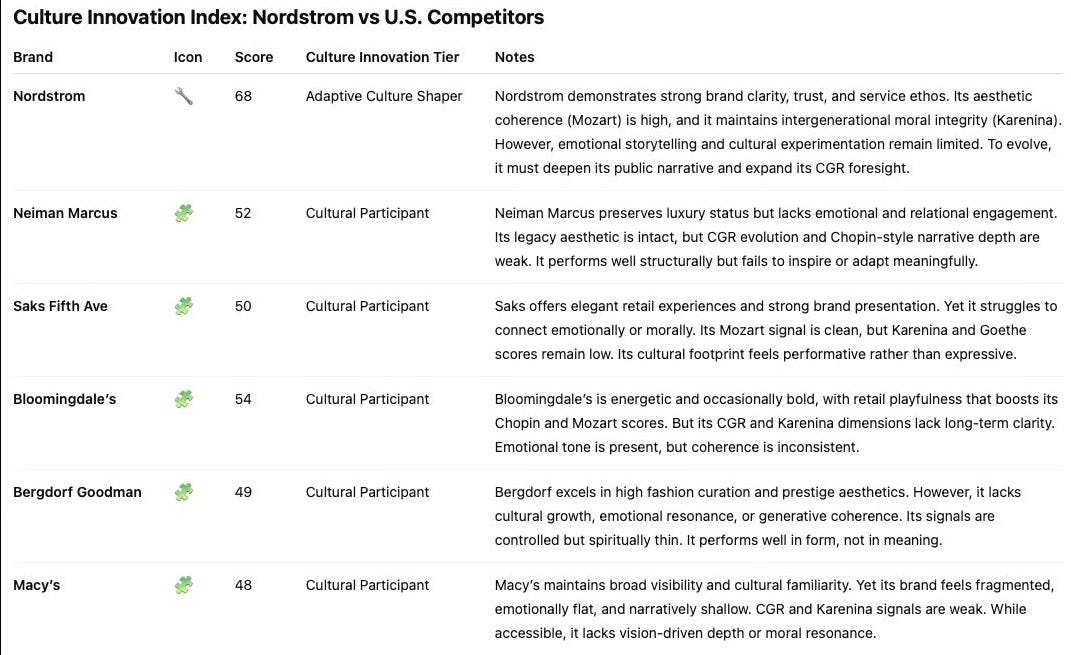

Reference. https://substack.com/@mindcastai/note/c-114463165. Nordstrom scored highest in major US department stores for cultural innovation.